[

The post on Opportunity Cost is important to understanding tax increases/decreases - note the nature of modern economies i.e. they are all 'mixed economies'].

Anyone who is a part of a society has to pay taxes. The taxes support the society by providing public goods (such as streets and street lights and libraries), social safety nets such as social security and medicare which help keep the elderly from dying on the streets (which, if allowed, would be a big moral and social problem - social safety nets makes society more livable and pleasant).

Anyone who doesn't want to pay taxes in their fair share is welcome to leave that society. [This sentiment is expressed by people saying "I'm American and Proud to Pay Taxes" - i.e. taxes are part of the American Society and its standard of living, as well as its way of life. You pay taxes to benefit on a social level. Third world countries where taxes go into government pockets and the military cannot offer a better society for its members for this very reason. A country using taxes appropriately for the benefit of all is like a beacon for democracy and of higher standard of living for the whole planet.]

For people who don't want to pay taxes, you can just say, "Just return all the profits you made by doing business in that society and you are even and you both can go your own ways". That is the benefit for a business paying taxes in a modern economy. You gain social benefits, infrastructure (such as roads so trucks or railways can carry your goods to market) and a population that has a higher standard of living and thus provide a market for your goods.

The Problem; Greed. We want all the benefits of a fully functioning and balanced society and democracy but we don't want to pay taxes. Thus you have the modern political problem in a mixed economy.

In the United States this natural problem with taxes is further compounded by people who are against tax increases for any reason, even if a decrease was bad economic policy. [Note: This modern economic problem can be understood as a result of 'echo chambers' employed by a small minority which seem to be above the law (at least as far as

individuals in an environment without regulations/law can manipulate them to their own benefit. This has created an overly negative atmosphere. Sad thing is that this fake economics,

if repeated often enough, can be believed as if it was actually economics.]

What is 'Tax Burden'?

[

Definition of tax burden:

The amount of income, property, or sales tax levied on an individual or business. Tax burdens vary depending on a number of factors including income level, jurisdiction, and current tax rates. Income tax burdens are typically satisfied by deductions from an individual's paycheck each time he or she is paid. Depending on the amount of allowances claimed by the individual, a tax burden may exceed the total amount of money deducted during the taxable period.

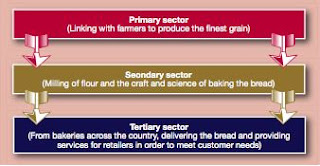

Understanding tax burden is easy. If an increase in taxes weighs heaviest on the poor and middle class then these sections of society have a higher cost of living. For example; an increase in the price of bread by one dollar will effect the poor the most, middle class next and it will have no effect on the rich. So an increase in price by one dollar on bread has its heaviest tax burden on the poor.

[The following images to explain tax burden are from

here .]

Another sign of a poorly balanced economy is a taxation system that presses heaviest on those least able to pay.

Larger amount of a poorer person's income is spent on food, so sales taxes press heaviest on the poor and middle class.

The following is an example of the tax burden being pushed onto the poor and middle class:

The video below summarizes how the

'conservative' echo chamber reacted to Warren Buffets article in the NY Times (

Stop coddling the rich).

Note: A 10% tax on both rich and poor will have a greater tax burden on the poor as they have less money to buy basic goods for survival while it makes no difference to the rich (i.e. the rich get one less vacation or car while the poor has less to eat or no vacations or luxury items). To say that a rich person is paying more is correct as 10% or a rich person's wealth is allot more than 10% of a poor persons wealth. However, the tax burden is clearly on the less well off in society. When dealing with small percentages of tax increase, to fight it and push it onto the poor is the very essence of

Laissez-Faire Capitalism.

Origin of today's tax debate;

4 notes on the above video:

1. Stephen Colbert keeps saying, "Taxes are job killers". This is a political slogan that has been emotionally charged with the use of

echo chambers.

2. Important note about reversing a failed economic policy (i.e. The Bush Tax Cuts):

The 90's were good for the economy and did not require a tax decrease.

3. The Bush Tax cuts have not created jobs but have done the opposite. This is an example of a failed economic policy (see

opportunity cost)

4. The deficit can be solved without raising taxes on the rich by decreasing medicare and social security (this trade-off represents a society that is moving more wealth into the hands of the few, i.e.

Laissez-Faire Capitalism )

Other problems in raising taxes:

Grover Norquist (in the interview below) is an example of someone who gets right-wing politicians, who are supported by a segment of the super rich who have the lowest taxes and tax burden in the States, to sign a pledge never to increase taxes.

Then Grover Norquist uses his access to

huge monetary funds to attack anyone who goes back on their pledge to him for

whatever reason. Thus many politicians refuse to raise taxes whatever the cost and will pretend there are other reasons that they don't raise taxes for.

Add all of the above to the new 'conservative'

echo chamber (controlled by a few) and you have the nonsense that is today's tax "debate" in the United States of America.